B.C. cleantech pioneer Svante Inc. is filling up on some fresh capital from Chevron U.S.A. Inc. in a Series E funding round that’s raked in US$318 million.

The Burnaby-based firm specializes in carbon capture technology and has previously inked deals with large oil and gas companies in Canada and the U.S., as well as large cement manufacturers, like Lafarge.

Chevron subsidiary Chevron New Energies (CNE) led the funding round.

“Innovation is key to enabling these types of breakthrough technologies and lower carbon solutions, and we look forward to applying our experience and expertise to help drive this effort forward,” CNE vice-president Chris Powers said in a statement accompanying Thursday’s announcement.

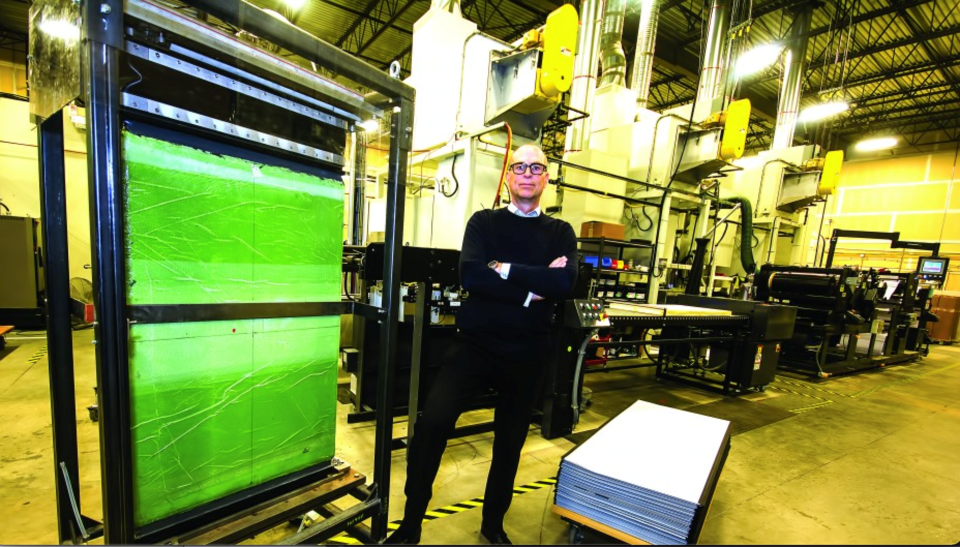

While chemical solvents known as amines serve as the backbone for most carbon capture technology, Svante has developed a device that uses solid material known as adsorbents to adsorb and redistribute carbon. Its adsorbent beds are also referred to as filters.

While CNE and Svante have recently teamed up on a pilot plant in California, the latest funding is being earmarked to help build a filter manufacturing facility in Metro Vancouver.

Svante CEO Claude Letourneau said in a video embedded within the announcement that the company’s factory will be able to build the filters for 10 plants with 1 million tonnes of CO2 capture capacity.

And the funding from Chevron gives the company runway to build a second plant, should there be a demand for it, Letourneau told BIV.

"That allows us to have enough funding to be cash-flow positive," he said in a phone call. "We have dry powder to be able to be able to build a second factory, if we need to, if the market picks up quicker than some people anticipate. So we'll be ready to expand.

"If the market picks up quickly, then we don't have to go out in the market again and raise money to build another factory. We will be able to have a reserve of money to be able to respond quickly to market conditions."

Should the company build a second factory, it would likely be in the U.S., Letourneau added.

"That's where the market is today and this is where most of the investment will be,” he said.

“The incentives for carbon capture and storage are much more attractive to investors in the U.S. than in Canada.”

The 45Q tax credit there was already considered an attractive incentive before the new Inflation Reduction Act bumped it up from US$50 per tonne to US $85 per tonne.

“This capital influx in a very challenging time on the financial markets is a sign of the strength and promise of Svante. The company is an absolute global leader in carbon capture, necessary for the energy transition. This is a more than trillion-dollar opportunity,” said Wal van Lierop, CEO and founding partner of Chrysalix Venture Capital, said in an email to BIV.

Chrysalix was an early investor in Svante.

“With this new capital, Svante is now ready for rapid commercial deployment and the opening up of a commercial CO2 market – also stimulated by recent actions of the Biden administration which have pushed carbon capture subsidies to $85 per [tonne],” van Lierop said.

Svante has been diligently capturing investor dollars for its carbon capture technology even before Thursday’s announcement.

As of last year it has raised US$195 million in private equity after concluding a US$100 million Series D funding round.

Ottawa has also shown a keen interest in the B.C. cleantech, earmarking $25 million in 2021 to help expand its production facilities in Burnaby.

Letourneau said the main market for Svante’s carbon capture technology will be refineries, lime production, blue hydrogen production and pulp and paper mills.