About half of the “climate tech” needed to whittle the world’s emissions down to net zero is still either in development or yet to be dreamed up.

Given that an estimated $100 trillion to $150 trillion will need to be invested globally in technology that addresses climate change by 2050 to achieve net zero, that presents a huge opportunity for Canadian climate tech companies, which have been punching way above their weight class in terms of drawing early stage venture capital, according to Boston Consulting Group (BCG).

But like other tech subsectors, Canadian climate tech companies often fail to cross the valley of death in Canada. By the time they achieve commercial scale, many have relocated.

Corvus Energy is just one recent example. Founded in 2009 in B.C, Corvus developed rechargeable batteries for marine transportation. In 2019, Corvus Energy relocated to Norway, where most of its customers are, and when it decided to build a new North American battery factory, it chose Bellingham, Wash. – not Richmond, B.C., where the company was born.

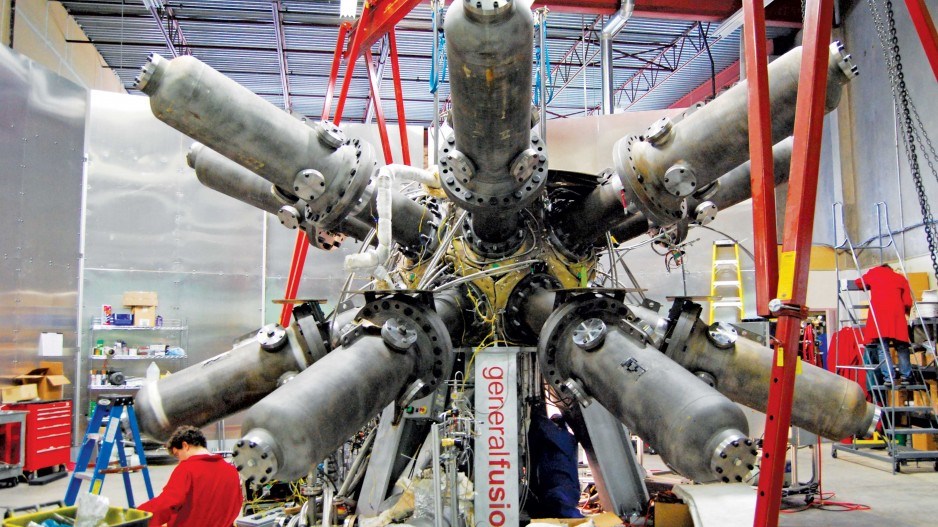

When General Fusion sanctioned the construction of its first demonstration plant, it chose the U.K. for a location, not Canada. And Canadian carbon capture pioneers, like Svante and Carbon Engineering, are finding most of their corporate investment partners in the U.S., not Canada.

Part of the problem is that Canadian companies under invest in research and development, and institutional investors tend not to invest in growth-stage Canadian companies, a new BCG study finds.

So, it’s an American oil company (Occidental Petroleum), not a Canadian one, that has been funding much of the commercial growth of B.C.’s Carbon Engineering. Only 17 per cent of the investment made by Canadians in climate tech has been in the Canada – 83 per cent was invested outside of Canada, the BCG report points out. This is despite the fact Canada is actually a leader in the clean-tech subsector of decarbonization (climate tech).

“Canadian institutional investors, by and large, have focused on de-risked segments, like solar, wind,” said Parham Peiroo, a Vancouver-based principal at BCG.

The BCG report credits Canadian governments for supporting research and development in the fields of decarbonization.

“This has resulted in delivering higher education and government R&D levels at or near the peer average on a per capita basis,” the report notes. “Unfortunately, this is where the good news on research and development ends.

"Anemic levels of private sector R&D and research collaboration have been a long-standing issue. This means Canada ranks second-to-last in the peer set on total R&D expenditure per capita.”

Canadian startups focused on various aspects of decarbonization punch well above their weight when attracting early-stage venture capital. They have attracted about 2.5 per cent of the global private investment in climate tech, Peiroo said.

“That’s an outsized share, given that our share of GDP globally is about 1.5 per cent,” he said. “Beyond attracting more than our fair share of investment, our startups are also globally recognized.”

He notes that the Global Clean Tech 100 list for 2023 has 12 Canadian companies on it, half of which are based in B.C. Of those six B.C. clean-tech startups, five are climate tech oriented (Ekona Power, Ionomr Innovations, Mangrove Lithium, Moment Energy, and Svante).

BCG found that Canadian climate tech startups have attracted 12 per cent of the global investment in sustainable fuels, 13 per cent of the investment in carbon capture and utilization and storage technology, and four per cent of hydrogen production investment.

“We’ve got strong talent and we’ve got a wonderful density of startups,” Peiroo said of the Canadian clean-tech space. “We have over 450 climate tech startups. That’s third in the world, behind the U.K. and United States.”

The problem for Canada is that many of these clean-tech companies may not stay in Canada as they grow. They find it hard to get past certain scale-up pain points, if they stay in Canada.

The BCG report found that only seven per cent of funding in the past five years has been above the US$50 million range, while it was 12 per cent in the U.S. It also notes that four-fifths of investments made by Canadian investors were outside of Canada.

“While we have this really strong density of early stage companies, we also need to cultivate an eco-system that continues to attract later stage capital to enable our scale-ups to grow,” Peiroo said. “Our study revealed that there’s some critical opportunities for us to fill the gap and overcome potential valleys of death.”

It urges Canadian companies and investors to invest more in Canadian climate tech companies and R&D.

“If we can get the right mix of Canadian corporate partners to ally with scaleups and support them, that will be an important and integral piece of the puzzle to keep these folks at home,” Peiroo said.